How Do Minnesota Tax Rates Stack Up

Note that Minnesota's individual income tax, sales tax and corporate income tax rates are at the higher end in all three tax types. Minnesota's income tax rates are higher than New York, District of Columbia, and all its neighboring states.

California has the highest tax rate of 13.30% for person's married filing jointly making $1,198,024. Minnesota's top marginal rate in 2021 of 9.85% kicks in at $276,200. A person living in California earning $276,200 would have a a tax rate of 9.30%.

At $276,200 Minnesota is the second highest tax rate in the nation after Oregon at 9.90%. But Oregon has no sales tax.

When it comes to sales tax, Minnesota does not have as extreme rates as it does for income tax. However, Minnesota is still one of the higher states for sales tax rates.

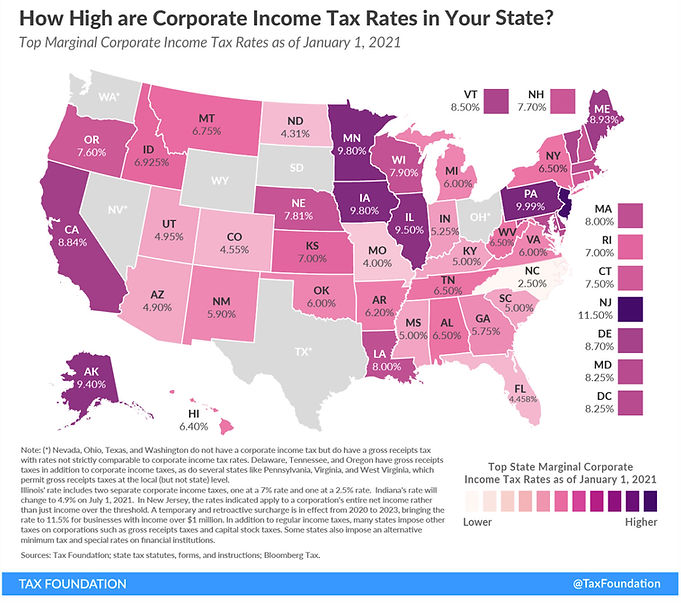

Minnesota's corporate income tax rate is one of the highest in the nation at 9.8%. Minnesota has a single rate (9.8%) that all taxpayers must pay. Other states have a graduated rate. For example, New Jersey's top marginal rate is 11.5% which kicks in at $1,000,000. However, for taxpayers earning less than $100,000 New Jersey's rate is graduated up to 9%. Minnesota's rate higher than California, Illinois, and New York; all considered high tax states. Minnesota's corporate income tax rates higher than Oregon (7.6% compared to 9.8%), but Oregon has no sales tax.